- Viewpoints

- Research

- HILL

This series of articles discusses results of the Hakuhodo DY Media Partners Institute of Media Environment’s “Media Innovation Survey 2018: 55 Services That Will Change People’s Lives,” which asked sei-katsu-sha in the four cities Tokyo, Los Angeles, Shanghai and Bangkok about emerging next-generation media environment-related services.

In the second part of this two-part article, Hakuhodo DY Media Partners Institute of Media Environment’s Maika Kobayashi asks Bangkok-based Hakuhodo Institute of Life and Living ASEAN (HILL ASEAN) researcher Prompohn Supataravanich and HILL ASEAN researcher and Hakuhodo DY Media Partners Institute of Media Environment visiting researcher Yuko Ito about the results for Bangkok.

Thailand seems to have an affinity for FinTech

MAIKA KOBAYASHI, HAKUHODO DY MEDIA PARTNERS INSTITUTE OF MEDIA ENVIRONMENT

I have heard that cashless payment has taken off in Thailand recently, but do Thai people have no hesitation to use their credit card information, etc. on the Internet?

PROMPOHN SUPATARAVANICH (DEE), HILL ASEAN

Thais have been using credit cards since before the Internet, so credit card literacy is higher than Internet literacy. I think that everyone is actually worried about their credit card information. And since their credit cards are directly connected to their money, I think they are more careful with them than information they share on the Internet.

YUKO ITO, HILL ASEAN

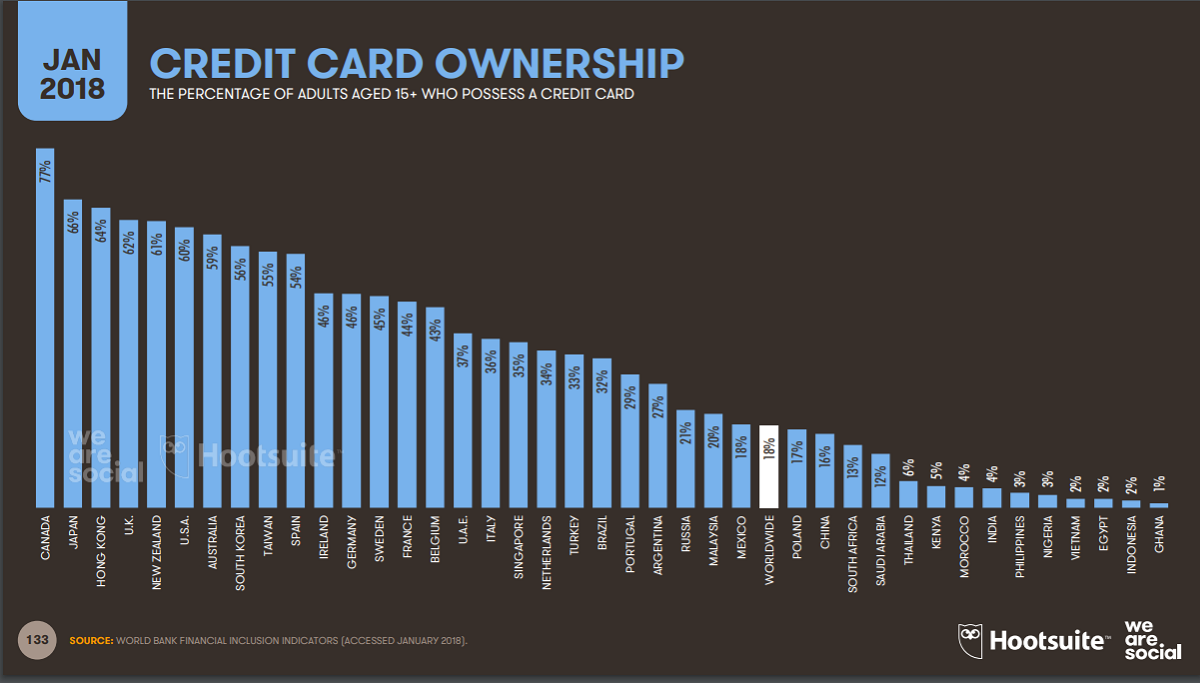

The credit card ownership rate in Thailand is clearly lower than in Japan. According to We Are Social 2018, 66% of Japanese have a credit card, whereas the comparative figure for Thailand is 6% (Fig. 1). Until now, credit card users were confined to certain segments, but I think that with the increasing number of online banking and mobile payment services linked to bank accounts, credit cards will be used by a wider range of people, and this may also change awareness of money and security.

■ Figure 1: We Are Social 2018 Global Digital Report

KOBAYASHI

Among the 55 Services That Will Change People’s Lives, Spending prediction and automatic transfer of funds was No. 4 in Thailand in terms of degree of interest. Do you anticipate that online banking will become more widespread?

DEE

I think this is related to Thai people’s general inability to save money. Looking at the data, Thailand is No. 2 in ASEAN in terms of rate of household debt (source: FT Confidential Research). I think that having to divvy up their meager salaries to pay multiple loans causes psychological stress. I think that this score is high as respondents imagine their stress will decrease if someone was to manage their loans for them automatically.

ITO

In addition, it seems that many Thai people send money to their parents and help out their families and relatives financially. Perhaps they think that since they have many people to send money to, it would be easier if they sent these payments by bank transfer rather than handing over cash, as AI will check their everyday spending patterns for them. Some may even think an automatic fund transfer service would be convenient, as they wouldn’t need to think about their expenses as AI could manage their savings for them, for instance by leaving 100,000 baht in their account and using the rest for other expenses.

DEE

Thai people don’t like to think about money [laughs]. There is data on retirement savings as a percentage of GDP, and while the figures for the US and France are over 100%, the figure for Thailand is 19% (Source: Bank of Thailand).

ITO

That’s scant savings for after retirement. Loose management of money is part of it, but rather than wasteful spending, Thais generally earn less than people in the West, and they have the caring habit of sharing any spare money they have with their families, so there are likely to be a variety of factors to this.

KOBAYASHI

Is there a pension system in Thailand?

DEE

It’s almost nonexistent. Even where there is, it’s a small amount, about 600 baht per month. Thailand has a population of 65 million and the total number of bank accounts is about 80 million. Of these, 88% have savings of less than 50,000 baht, and only 1% have savings of more than 1 million baht. (Source: Bank of Thailand)

KOBAYASHI

Thinking about living on 600 baht, I guess people will need to continue relying on their children through the generations?

ITO

Thais place a great deal of importance on family, so children looking after their parents is something that is likely to continue of a long time. I believe that the current generation of parents still continues to believe that they took care of their own parents and that it is only right that they should be taken care of by their children after retiring.

QR code payment is spreading rapidly

KOBAYASHI

By the way, how widespread is the QR code?

DEE

I think cashless payment is very widespread in Thailand. In 2017, Thai and other banks established system standards for QR code payment, and all banks are now QR code payment compatible.

KOBAYASHI

In Japan, if I heard about QR code payment at a bank I couldn’t guess what it might mean. It can be used with Thai banks, but what specifically does it make possible?

DEE

Thanks to this standard, you can now pay at any store that uses QR codes by scanning the code with any bank’s app. Until now, people sent money to each other by entering their account numbers, but for example, if Ms. Ito produced a QR code from Bank A, I could send her money by scanning the code, even if I’m with Bank B. It’s very convenient because it saves people the time and effort of entering their account numbers, which is why it’s spreading.

KOBAYASHI

I see, it’s set up so it’s convenient for everyone, which is driving the speed with which it’s spreading.

DEE

There are two reasons for the increased penetration. One is that after the Bank of Thailand’s announcement about QR code payment, the Thai Ministry of Finance created another system called Prompt Pay. This is used by the government when it pays refunds or payments to people. Previously, money was paid by check and other means, but with the Prompt Pay system, money is paid automatically by the government into your account if you register your Thai national ID number, mobile phone number and account information.

In Thailand, tax returns are done every year, and many people receive a refund, so when this announcement was made, the number of users increased immediately. Today, 39 million people use the system, about half the population.

The other reason is that with about 10 million Chinese tourists visiting Thailand every year, the QR code payment system was already in place for them. Even before Thai people had access to it, they could see QR code payment in use daily at convenience stores and other locations for many years. When they were able to use it themselves, instead of “What is this machine?” it was more like “Now we can use that thing that Chinese people were using.” I think it took off quickly because people were used to seeing it. I’d like to thank the Chinese.

ITO

A great many Chinese tourists visit Thailand, and during the Lunar New Year, everywhere was decked out in “Chinese red,” and staff from restaurants and hotels welcomed them wearing qipao. Apparently Thai tourist visas for Chinese nationals were free during the New Year holidays, and Chinese tourists flocked to the country.

KOBAYASHI

Has the QR code been taken up by all age groups?

DEE

There are differences between age groups. Younger people, such as college students, use it and adapted quickly. In some universities, QR codes can be used at all cafes, and some students seem not to want to carry cash. When you go to Siam Square and other places where young people gather, QR code payment is taken for granted, and you’ll often see it even if you don’t use it yourself. I think usage will change greatly in the next five years or so.

ITO

What we’re talking about is limited to urban areas, and if you go out of the cities, payment services are not yet in place, so I think that cash is still king there. Thailand seems to have a high level of trust in cash, so I think it will take time for everything to change.

DEE

That’s right. Even if five years from now Bangkok itself has become almost cashless, I think that there will still be a long way to go for the rest of the country.

Unmanned and self-driving cars would be difficult in reality

KOBAYASHI

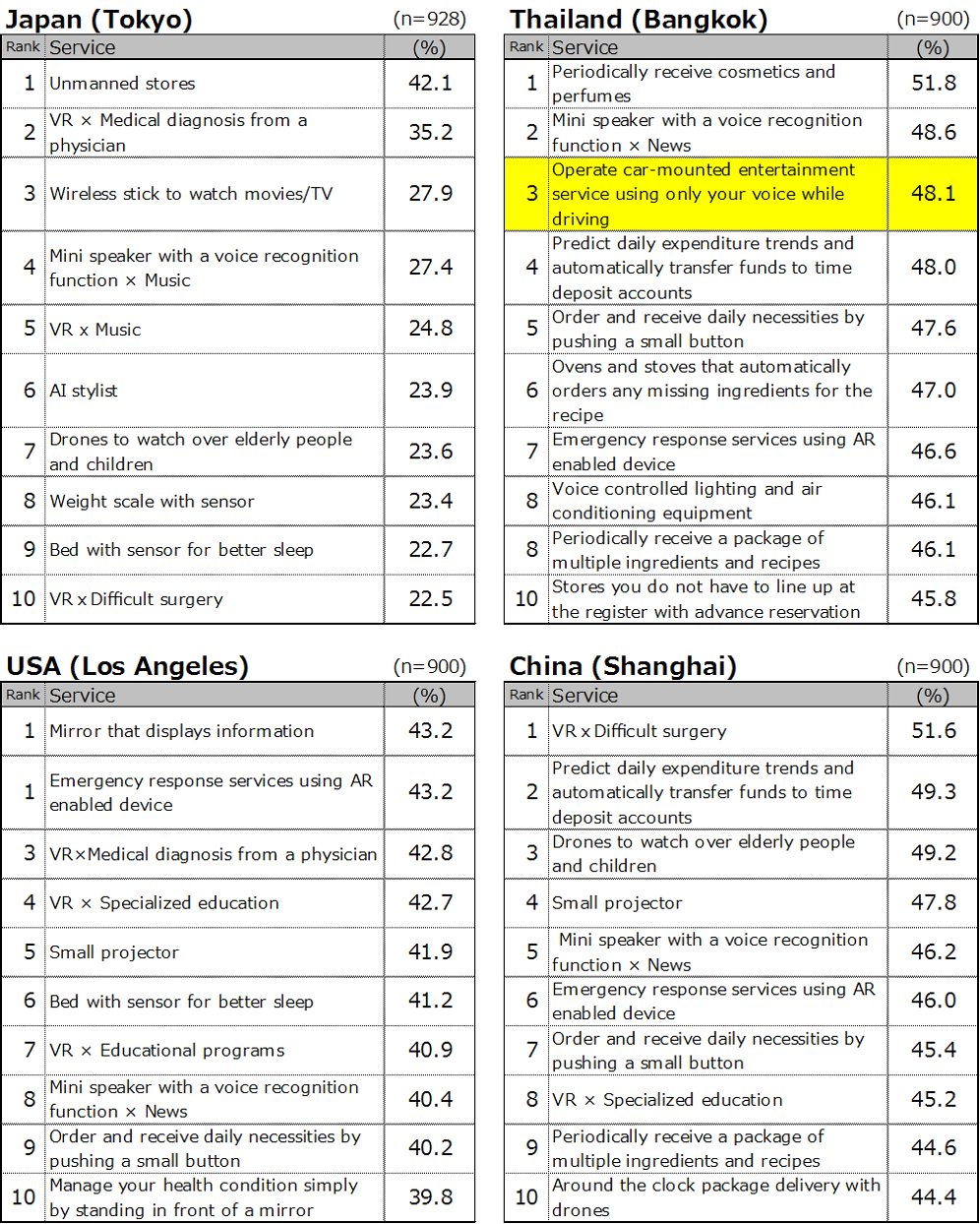

Going back to the rankings, while there is not much interest in self-driving and unmanned cars in Thailand, in-car entertainment ranks third (Fig. 2). What do you think about this?

■ Figure 2: 55 Services That Will Change People’s Lives: Top 10 services in each country by degree of interest

ITO

Traffic congestion is a massive problem, and I think that this result is a reflection of the huge interest in trying to enjoy time stuck in traffic jams. Because traffic jams aren’t something people can solve by themselves…

DEE

The lack of interest in self-driving and unmanned cars is probably related to how Thai people are. If you’ve ever been to Thailand, you’ll know that motorcycles go every which way, so it’s hard to imagine self-driving cars working in that situation, right? So, I think it’s not that people are not interested in self-driving cars, but that they wonder if they’d really be possible. But if everyone took up self-driving cars at the same time, I’m sure they’d be relieved.

ITO

I think the low rating for self-driving cars is a result of a high “they would be good to have” rating coupled with the opposite sentiment, “I know they’re possible, but they probably wouldn’t work in this country.”

KOBAYASHI

Thank you very much. Finally, looking at the data as a whole, are there any things you think differ from area to area, or are common to all of Thailand?

DEE

Besides money, I think the “love of new things” is a characteristic shared by Thai people. I believe that love for the latest technologies and not rating self-driving cars and unmanned stores are trends not just of the cities but across Thailand as a whole. Regarding unmanned services, it seems that many Thai people feel that they are being given better service the more people there are. In contrast to Japan, where there is a shortage of human resources, Thailand has a wealth of human resources and labor costs are still low, so people might prefer manned services. I think urban areas have higher Internet literacy. In terms of security, there are more surveillance cameras in urban areas, so I think there would be more people there who are concerned about information being transmitted to the government than in rural areas.

KOBAYASHI

Thank you very much. Let us know if there is anything else.

ITO

In Thailand, people are highly receptive to services, so new services spread really quickly. I think that Japan may even be falling behind. Japan’s very strict government regulations are a factor there. In Thailand, transportation, delivery services, and other transportation systems will become extremely convenient in the future. The number of Grab (a taxi-hailing app with a high share of the market in ASEAN) drivers in Thailand is increasing, and tourists choose this option based on word of mouth that they are safer than using local taxis.

Also, Japanese people usually use cash and credit cards, but as Dee said, bank-based mobile payments will spread quickly in Thailand. Frictionless financial services will spread rapidly, I believe.

I talked about different age groups earlier. In Thailand, even senior citizens use smartphones, so I think the transfer of services will be smoother than in Japan. Thanks to cheap smartphones, old age and low incomes are no barrier to their use, so I think the transition period will be very smooth.

KOBAYASHI

Dee, Ms. Ito, thank you very much.

Hakuhodo DY Media Partners Institute of Media Environment summary

In this article we discussed the situation in Thailand, including in comparison with other ASEAN countries. While total interest in new products is higher in Thailand than in other countries, when we actually drilled down, we realized that there were differences in perceptions between countries where similar products and services have already emerged and those where these products and services are not yet available. Where a lot of technologies are already available and people can imagine how it would be to use a new service, excitement tends to go down and interest tends to be low.

It is amazing that QR code payment is already used by nearly half of the population of Thailand in under a year. Looking at this rapid spread, it seems that Thai peoples’ desire to adopt new technologies is up there with that of the Chinese. It is likely that other services that have not yet been launched in Thailand will become popular very quickly once introduced. If they tap into Thai people’s positive attitude to change, we can probably expect various services and fields to become more convenient in one fell swoop.